December and January could be a bad memory when you have grid-tied solar panels. But you need to have the long-term view. Even with the dreary May weather, the microFIT program is working out. At this point it is still too early to say what the ideal price is to achieve a reasonable return on investment. We are roughly 3/4 through the year and we are nearly equal to our loan payment [10 yr amortization]. However we are going into the long summer days and will more than exceed the loan. But that is only reasonable - many businesses require a 3 year return on investment so why shouldn't a homeowner have their own small solar business on their roof and get 7-10 year return on investment?

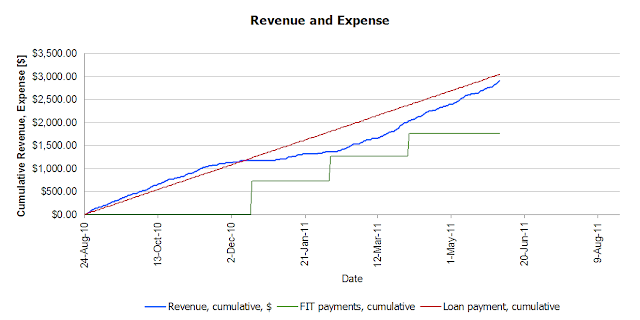

I show the cumulative revenue below.

The blue revenue curve is the daily generation from 24 August 2010 to 3 June 2011. I've discussed the low generation in earlier posts, but here we see there are enough sunny days that we are catching up to the cumulative loan. The net revenue was higher from August to December where it dropped below the loan payment. However, we now how enough data to see the growth in revenue that started in February has allowed the system to virtually catch up to the cumulative loan payments. On 3 June loan payments was $3043 and generated power was $2900. However, we should be expecting a cheque from Guelph Hydro soon - payments received to date have been $1762.

No comments:

Post a Comment